Are you struggling to streamline your accounts payable process?

Well…you are not alone.

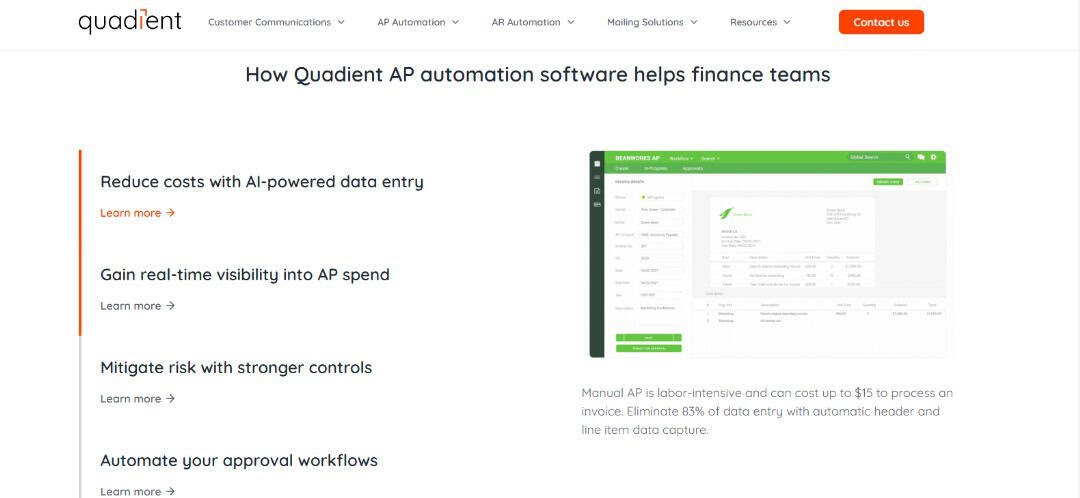

Manually managing invoices, approvals, and payments can be a constant uphill battle. That’s where Beanworks steps in, offering a solution to cut costs and save time through AP automation.

Now branded as Quadient AP by Beanworks, this platform promises seamless integration with accounting systems and AI-powered efficiency.

But does it live up to the hype? Keep reading to find out. 😊

What is Beanworks AP Automation?

Beanworks, now part of Quadient, is an accounts payable automation tool designed to make finance teams more efficient. It replaces tedious manual tasks with automated workflows, giving you more control and visibility over your AP process.

Beanworks AP integrates with popular accounting systems like QuickBooks, Sage, NetSuite, and Xero. Whether you’re handling hundreds or thousands of invoices, this tool scales to fit your needs.

How Does Beanworks AP Automation Work?

Beanworks simplifies AP workflows into a step-by-step process:

- Uploading Invoices: Scan or upload invoices directly into the system. The software uses AI to extract relevant details like invoice numbers, dates, and amounts.

- Automating Approvals: Set up custom approval workflows tailored to your organization. Invoices are routed automatically to the right team members for review and approval.

- Tracking Payments: Once approved, payments are processed and tracked in the system. You’ll have a clear record of what’s been paid, pending, or flagged for review.

The platform’s user-friendly interface makes navigating these processes straightforward, even for non-tech-savvy users. It’s accessible via a web app and mobile devices so that you can manage approvals and payments anytime.

Features of Beanworks

Beanworks has features catering to every aspect of the accounts payable process. Here’s an overview:

1. Invoice Management

Upload invoices digitally and let AI handle the data entry: no more manual input errors or lost documents. You can also match invoices to purchase orders and receive documents effortlessly.

2. Purchase Order Automation

Create and track purchase orders with full visibility. Set spending limits by department or vendor to ensure better control over planned expenditures.

3. Payment Processing

Approve and release payments securely and quickly—batch payments for processing in seconds while maintaining a digital audit trail to ensure compliance.

4. Expense Tracking

Manage expenses on the go with access to receipts and reports anytime. This feature integrates seamlessly with your ERP system for streamlined workflows.

5. Real-Time Reporting

Gain full visibility into your company’s spending through dashboards and analytics. Real-time expense tracking allows for informed decision-making and avoids surprises during audits or budget reviews.

These features are designed to save you time and help your team focus on strategy, not admin.😄

Pricing: How much does Beanworks cost?

It all depends on certain factors.

While specific pricing isn’t readily available online, factors like your business size, number of users, and the modules you select influence the cost.

For small businesses, Beanworks offers solutions that scale without breaking the bank. The platform’s customization and integration capabilities make it a worthwhile investment for larger enterprises.

To get a tailored quote, it’s best to book a demo through their website.

>>> See current plans here <<<

Pros & Cons of Beanworks AP Automation

Every tool has its strengths and weaknesses, and Beanworks is no exception. Here’s a quick breakdown:

Pros

- Simplifies accounts payable processes: From invoice uploads to payment approvals, Beanworks automates tedious tasks, saving time and reducing errors.

- Customizable workflows: Tailor the approval process to match your team’s unique structure and needs.

- Integration with leading accounting platforms: Seamlessly connects with QuickBooks, Sage, Xero, and more, ensuring a smooth transition.

- Strong customer support: Many users praise the responsive and knowledgeable support team for resolving issues promptly.

Cons

- Cost-effectiveness for smaller businesses: The software’s price may outweigh the benefits for companies with low invoice volumes.

- Learning curve for first-time users: While the interface is user-friendly, new users might require training to maximize its potential.

- Limited features in the base plan: Advanced features like expense tracking and purchase order automation might require additional modules or upgrades.

When weighing the pros and cons, it’s clear that Beanworks is designed for businesses ready to scale and streamline their operations.

However, smaller teams might want to consider their budget and workload before committing.

Comparisons with Beanwork’s Competitors

How does Beanworks measure up against alternatives like AvidXchange and Paymerang? Let me break it down:

AvidXchange

- Features: Both platforms offer robust invoice automation and payment processing, but AvidXchange specializes in mid-to-large businesses.

- Pricing: AvidXchange’s pricing tends to be higher, making Beanworks more appealing for companies on a budget.

- User Experience: Beanworks’ simpler interface often wins points for accessibility, while AvidXchange may feel overwhelming for smaller teams.

Paymerang

- Features: Paymerang focuses heavily on payment automation, while Beanworks offers a more comprehensive AP suite, including purchase order and expense management.

- Integration: Beanworks shines with its ERP integrations, making it a better fit for businesses using QuickBooks or Sage.

- Customer Support: Both platforms have strong support, but Beanworks users often highlight their team’s attentiveness.

For businesses looking for a balance between price and features, Beanworks often emerges as the winner.

AvidXchange might suit large corporations, while Paymerang appeals to those focused solely on payment automation.

Is Beanworks Worth It?

The big question: Is Beanworks the right fit for your business?

1. For Mid-Sized to Large Businesses

The answer is a resounding “Yes!“.

With robust automation features, seamless integration with accounting platforms, and scalability, Beanworks simplifies accounts payable for businesses managing high invoice volumes.

The savings in time and effort, combined with enhanced accuracy, make it a cost-effective solution for these organizations.

2. For Small Businesses

It’s a maybe. Smaller companies with limited AP processes might find the software’s cost a bit steep compared to the workload it reduces. However, the investment could pay off if scaling is on the horizon or manual processes are draining your team’s resources.

How to Decide

Here’s a quick checklist to assess whether Beanworks fits your needs:

- Invoice Volume: Automation will save significant time if your team processes hundreds of invoices monthly.

- Budget: Compare Beanworks’ pricing to the cost of errors and inefficiencies in manual AP management.

- ERP System: Check whether your accounting system integrates with Beanworks for a seamless experience.

- Growth Plans: If your business is scaling, automating now can prepare you for an increased workload later.

Beanworks is a tool that pays off when used to its full potential. The upfront costs must be balanced against the long-term benefits.

Final Words

Streamlining accounts payable isn’t just a luxury, it’s necessary for businesses aiming to optimize operations and cut costs.

Beanworks by Quadient delivers on its promise with features like invoice automation, expense tracking, and seamless integration with major ERP systems.

Whether you’re managing high invoice volumes or looking to prepare for growth, Beanworks offers tools that can save time, reduce errors, and provide invaluable real-time insights.

Ready to automate your AP process?

Don’t just take our word for it—experience it yourself.

Book a demo with Quadient AP by Beanworks today and see how it can transform your accounts payable workflow.