Small businesses are increasingly moving away from paper checks and manual bookkeeping. The need for fast, secure, and flexible digital payment tools has never been higher—especially for busy teams juggling everything from payroll to vendor payments.

That’s where Melio comes in. It’s a modern accounts payable platform for small to mid-sized businesses. Whether you’re paying by bank transfer or credit card, Melio lets you send payments even if your vendors only accept checks or ACH.

In this review, I’ll cover everything you need to know—from key features and benefits to Melio pricing, pros and cons, integrations, and how it actually works.

What is Melio?

Melio is a cloud-based B2B payment platform that helps small businesses manage their payables without needing a full accounting department.

You can pay bills directly from your bank account (ACH) or use a credit card—even if your vendor doesn’t accept cards.

It’s designed to simplify the whole bill payment process. For example, if your vendor only takes checks, Melio will mail one on your behalf—for free.

That means you get to keep using your credit card for points or cash flow, while your vendor gets paid the way they prefer.

You can also manage all your vendor payments from one place using the Melio app, which syncs easily with tools like QuickBooks.

Whether you’re paying freelancers, suppliers, or service providers, it’s all done in just a few clicks.

Who is Melio best for?

If you’re a freelancer or solopreneur juggling client payments and vendor bills, Melio can save you serious time.

You can track what’s due, pay online, and even use your credit card to cover cash flow gaps without needing accounting software expertise.

Small business owners who want to pay vendors by credit card (even when the vendor doesn’t accept them) will find Melio especially useful.

You get to keep your rewards or manage cash better, while Melio takes care of the backend—sending ACH or paper checks as needed.

It also works well for teams that need approval workflows and want to reduce manual work. Melio lets you assign roles, add approvers, and automate recurring payments—great for growing businesses.

And if you’re looking for a free, easy-to-use bill pay solution that doesn’t tie you to a big software commitment, Melio fits that bill too.

It’s convenient for QuickBooks users—the sync is smooth, the setup is quick, and there’s barely a learning curve. You can be up and running in minutes.

Absolutely! Here’s a polished and structured version of your content, with each Melio Key Feature given its own subheading for clarity and flow:

Melio Key Features

Melio offers a range of simple, flexible tools that make it easier for small businesses to manage, schedule, and streamline vendor payments—without the extra cost. Here are some

1. Pay Vendors with a Credit Card (Even If They Only Accept ACH or Checks)

One of the most helpful features of Melio is the ability to pay vendors using your credit card—even if your vendor only accepts ACH transfers or checks.

For example, if your supplier only takes bank transfers but you want to earn credit card rewards or manage cash flow more flexibly, Melio makes it possible.

They’ll process the payment via your card and deliver it to your vendor as an ACH or mailed check. This gives you more control over how and when you pay.

2. Bill Capture and Payment Scheduling

Forget tracking due dates manually or making last-minute payments. With Melio, you can upload bills or have them sent directly to your Melio inbox.

From there, you can easily schedule the payment for a future date. So if rent is due on the 1st, but you want to hold onto your cash until the 30th, you can schedule it in advance—no more rushed logins or missed deadlines.

3. Approval Workflows for Teams

Melio simplifies team collaboration with approval workflows. You can assign roles—such as who can enter bills and who can approve payments.

For instance, a junior employee might input vendor invoices, while a manager or business owner approves them. This helps small teams stay organized and ensures a clear trail of who approved what.

4. Vendor Management Without Hassles

Melio makes it easy to manage vendors. You can invite them to enter their payment details—but even if they don’t, it’s not a problem.

Melio can still send payments using just basic vendor information. This is especially useful when working with local contractors or vendors unfamiliar with digital tools.

5. Free Check Mailing

If your vendor prefers a paper check, Melio has you covered. They’ll print and mail the check for free on your behalf.

No need to write checks, buy envelopes or stamps, or make a trip to the post office. Just click “send,” and Melio handles the rest—perfect for businesses that still rely on traditional payment methods.

6. Seamless Integration with QuickBooks

Melio integrates effortlessly with QuickBooks. Once connected, your bills and payments automatically sync—no need for double data entry.

For example, if you pay a vendor through Melio, that transaction will appear in QuickBooks without any extra work. It’s ideal for businesses already using QuickBooks to manage their finances.

7. Monthly Fees

Melio offers powerful bill pay features with monthly subscription. Most tools are completely free to use in the free plan, with optional fees for things like credit card payments (2.9%) or expedited processing.

You can manage your accounts payable efficiently without adding new software costs to your budget.

Melio Pros and Cons

No platform is perfect—but Melio checks many boxes for small businesses. Here’s a quick look at where it shines and where it might fall short.

Pros:

- Sending payments via bank transfer costs $0. That’s a huge win for keeping expenses low.

- Melio converts the payment to ACH or check, so your vendor doesn’t need to do anything.

- No technical skills are required. The Melio app is clean, intuitive, and easy to navigate—even for non-techies.

- Bills and payments show up in your accounting automatically. It saves time and reduces manual entry errors.

- Melio is pay-as-you-go. You only pay for optional upgrades like faster delivery or credit card use.

Cons:

- While ACH is free, using a credit card comes with a 2.9% fee, which can add up if used frequently.

- Melio only supports payments within the U.S.—no international transfers yet.

- The dashboard and reporting features are limited. They are great for day-to-day use but not ideal for in-depth financial analysis.

Still, the pros far outweigh the cons for small teams and solo business owners—especially if you want something fast, flexible, and free to start.

Melio Pricing

One of the best things about Melio is its transparent, pay-as-you-go pricing. You can use most of the platform’s features for free—only paying for optional services when needed.

Here’s the breakdown:

- ACH bank transfers – Free

- Send payments via bank transfer at no cost. Perfect for vendors who accept ACH.

- Credit card payments – 2.9% fee

- If you want to use a credit card—even when the vendor doesn’t accept it—Melio charges a 2.9% processing fee.

- Check mailing – $1.5 for standard delivery

- Melio will print and mail checks to your vendors for $1.5. Want it there faster? Expedited delivery is $20.

- International wire transfers – $20 flat fee

- You can send USD-to-USD payments abroad for a flat $20 per transaction. However, Melio payments are U.S.-based, so international options are limited.

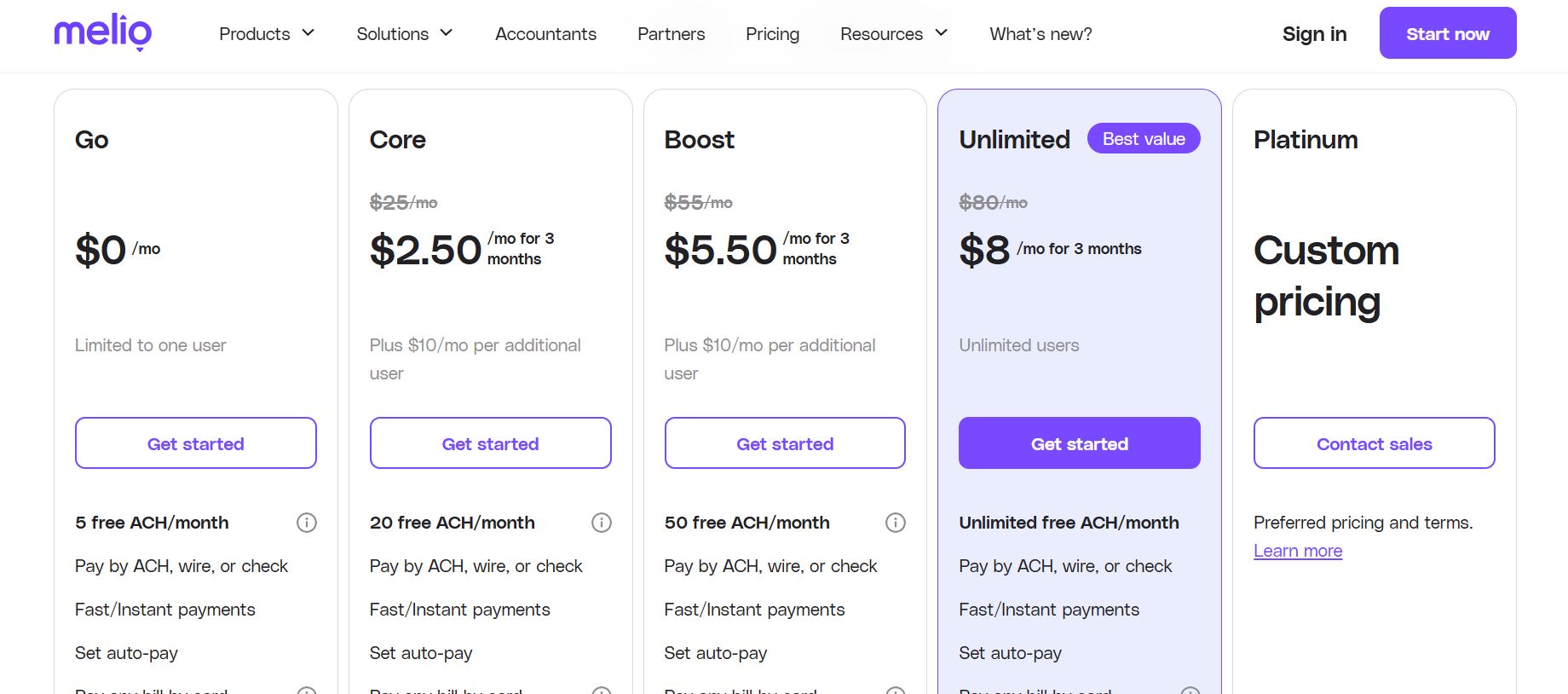

Melio runs on a Subscription package for either monthly or annual payments based on yor business needs.

Pricing Plan:

Go – $0/month: Free plan

- 5 free ACH/month

- Free AR & Invoicing

Core – $25/month

- Everything in Go,plus:

- 20 free ACH/month

- Free AR & Invoicing

Boost – $55/ month

- Everything in Core, plus:

- 50 free ACH/month

- Advanced user roles

Unlimited – $80/month

Everything in Boost, plus:

- Unlimited free ACH/month

Platinium – Custom Pricing

Visit Melio Pricing Page to learn more

Melio review: Final verdict

If you’re looking for a flexible, affordable, and modern way to handle bill payments, Melio is hard to beat. It’s built for small businesses that want to streamline their payables without piling on extra software costs or complexity.

With free ACH transfers, credit card payment options, and smooth QuickBooks integration, Melio gives you real functionality—without the overhead. The platform is easy to use, works right out of the box, and doesn’t lock you into monthly fees.

It’s best for U.S.-based businesses that care about speed, control, and convenience in a digital payment tool. And since most features are free, there’s zero risk in trying it.

Related Article: QuickBooks Online Review: Is QuickBooks the Best Accounting Software for Small Businesses?