If you’re running a small business, managing your books probably isn’t your favorite task. But it’s one of the most important. That’s where QuickBooks Online steps in.

In this QuickBooks review for small businesses, I’ll explain what it is, what it does well, and where it might fall short. You’ll learn about features, pros and cons, pricing, and how it compares to the competition.

Whether you’re just starting or looking to switch, this guide will help determine if QuickBooks is the right fit.

What is QuickBooks Online

QuickBooks Online is cloud-based accounting software made by Intuit. It’s designed for small businesses that want to track income, manage expenses, send invoices, and run reports—all in one place.

Because it’s cloud-based, you can log in from anywhere [QuickBooks online login], which is great if you’re working remotely or juggling things on the go.

It also syncs with your bank accounts, which means fewer manual entries and less risk of missing transactions.

There are multiple plans, depending on your business size and needs. Whether you’re a solo freelancer, a growing eCommerce shop, or managing a team with payroll needs, there’s likely a plan that fits.

I like how it automates repetitive tasks—like reconciling accounts or sending recurring invoices. That alone can save hours each month.

It’s not just about bookkeeping. QuickBooks Online also offers tools for sales tax tracking, inventory management, and payroll integration.

That makes it more than just accounting software—it’s more like a financial command center for your business.

How does QuickBooks Online work?

QuickBooks Online works through the cloud, which means you can log in anytime from a web browser or mobile app.

Whether you’re checking sales at your desk or reviewing expenses from your phone, everything stays synced in real-time.

You can easily track income, record expenses, send invoices, and run detailed financial reports—all with just a few clicks.

I find the dashboard super helpful. It gives you a quick overview of your business health when you log in.

One of the biggest perks? You can share your books securely with your accountant or team members—no need to email spreadsheets back and forth. You add them as users, giving them access to what they need.

Everything you enter—a new expense, a paid invoice, or a bank transaction—instantly updates all devices. So, if your accountant logs in from their office, they’ll see the same info you do.

It’s simple, efficient, and designed to organize your business finances without the headache.

QuickBooks Online Features

Here are some quickbooks features;

1. Automated Invoicing and Payment Reminders

One of my favorite features in QuickBooks Online is automated invoicing and payment reminders. You can create an invoice in minutes, set it to repeat, and let QuickBooks handle the rest.

For example, if you bill a client $500 on the 1st of every month, you can set up a recurring invoice—and QuickBooks will send it automatically.

If that invoice isn’t paid on time, it’ll also send polite reminders so you don’t have to chase payments manually. It’s a real time-saver, especially if you have multiple clients or repeat projects.

2. Expense Tracking with Receipt Scanning

Let’s say you grab lunch with a client or buy office supplies—just snap a photo of the receipt using the QuickBooks mobile app. It’ll automatically pull in the amount, date, and vendor.

Everything gets categorized and synced with your books. You won’t have to worry about losing paper receipts or guessing where your money went at year-end.

3. Sales Tax Calculations

Sales tax rules can get tricky if your business operates across states or countries. QuickBooks tracks the latest rates, applies the right ones based on customer location, and helps you prepare for filings.

This feature helps reduce manual errors and ensures compliance with ever-changing tax laws.

4. Integrated Payroll Processing

Payroll is an optional add-on, but it’s deeply integrated. You can run payroll, calculate tax withholdings, and even pay employees directly—all from the same dashboard.

This streamlines your HR and accounting functions and reduces the need for separate tools or services.

5. Customizable Financial Reports

QuickBooks offers customizable financial reports that give real insights into your business’s performance. You can run profit and loss statements, balance sheets, or cash flow reports and tweak them based on date ranges, customers, or projects.

For instance, if you want to see how profitable a certain client has been over the last six months, it takes just a few clicks.

6. Bank and App Integrations

QuickBooks connects to most major banks, so your transactions are imported automatically—no manual entry needed.

It also integrates smoothly with tools like PayPal, Shopify, Square, and even productivity apps like Slack or Trello (with the right setup).

This helps create a streamlined workflow where your financial data is always up to date, no matter where you’re working.

Quickbooks Pros

QuickBooks Online has several strong points that make it a solid choice for small businesses:

- Scalable pricing plans for different business needs

- Whether you’re a solo entrepreneur or managing a growing team, QuickBooks offers multiple plans that grow with your business. You don’t have to overpay for features you don’t need upfront.

- Robust mobile app capabilities

- The mobile app isn’t just for viewing data—it lets you snap receipts, send invoices, and check reports on the go. I’ve used it to log expenses right from the parking lot—it’s that convenient.

- Wide range of integrations

- QuickBooks works well with tools you’re likely already using—PayPal, Shopify, Square, Stripe, and hundreds more. This makes it easy to build a streamlined system without jumping between platforms.

- Easy collaboration with accountants via cloud access

- You can securely invite your accountant or bookkeeper to your account. They get real-time access to your data, so no more file-sharing back and forth or outdated info.

Cons

Of course, no tool is perfect—and QuickBooks Online has a few drawbacks to keep in mind:

- Higher price point compared to some competitors

- While powerful, QuickBooks can feel pricey—especially if you want extras like payroll or time tracking. It’s not always the most affordable option for small startups.

- Occasional steep learning curve for beginners

- If you’re unfamiliar with accounting tools, the interface can initially be overwhelming. Even though the layout is user-friendly overall, some features take time to figure out.

Quickbooks Pricing

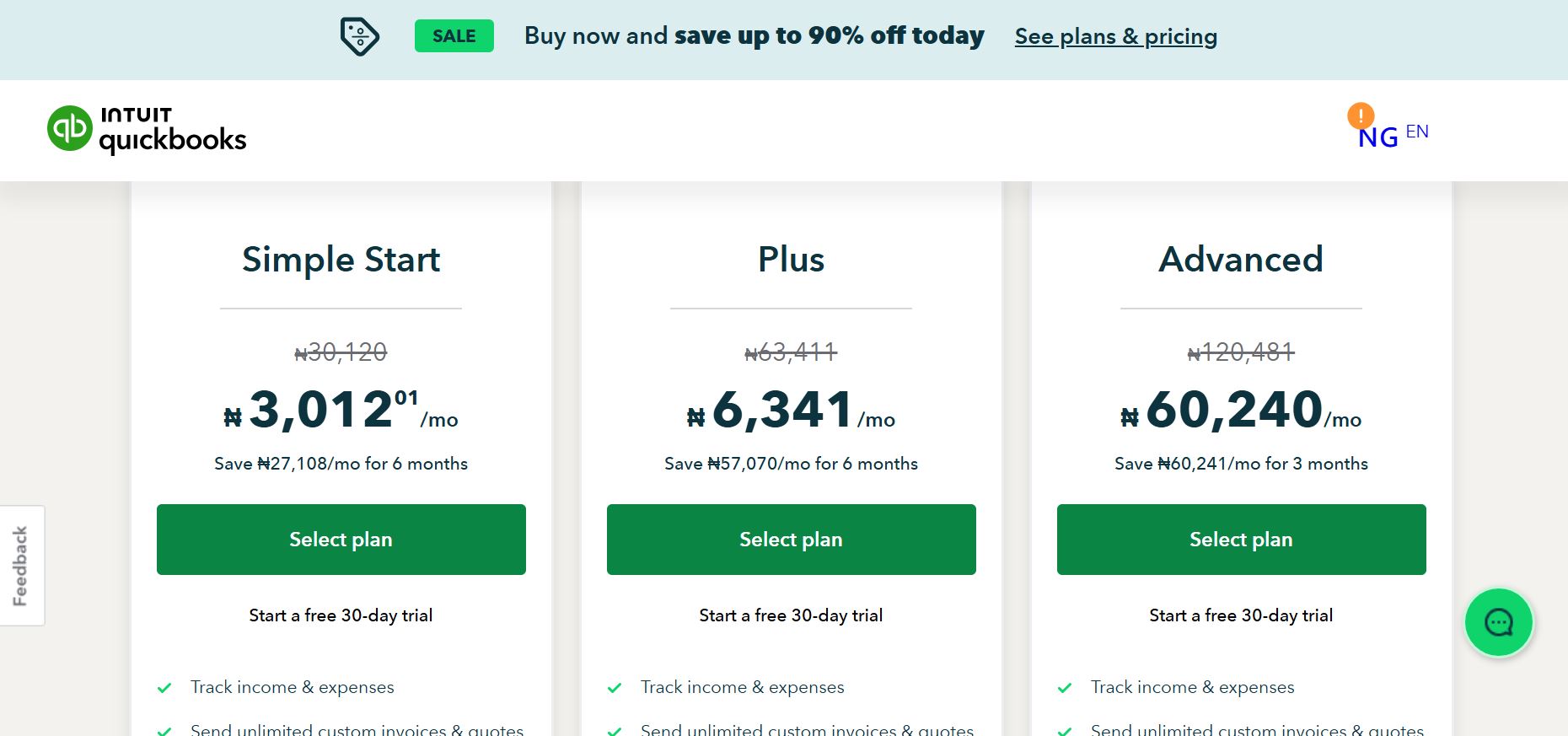

QuickBooks Online offers four main pricing tiers, so you can choose what best suits your business without paying for unnecessary extras.

- Simple Start : $35/month

- Essentials: $65/month

- Plus: $99/month

- Advanced:Supports up to 25 users – $235/month

If you’re looking for QuickBooks for small business free options, there’s no permanent free version—but you can usually try it free for 30 days.

Visit QuickBooks Pricing Page to learn more

Should you choose QuickBooks Online?

If you’re looking for a powerful, all-in-one accounting solution, then yes—QuickBooks Online is a strong choice for most small businesses.

It gives you everything from automated invoicing and expense tracking to payroll and advanced reporting, all in one place.

It’s especially valuable if you work with an accountant or need real-time insights to run your business smarter. If you’re willing to invest a little more for robust tools and seamless integration, it’s worth it.

But if you’re a solopreneur with very simple needs (and a tight budget), QuickBooks might seem like too much. In that case, a more affordable tool like Wave or FreshBooks could be a better fit.

Bottom line?

QuickBooks Online is best for small business owners who want scalability, reliability, and pro-level features—all backed by Intuit.

Related Article: Comprehensive Review of Papershift GmbH: Features, Benefits, and Integrations for Businesses