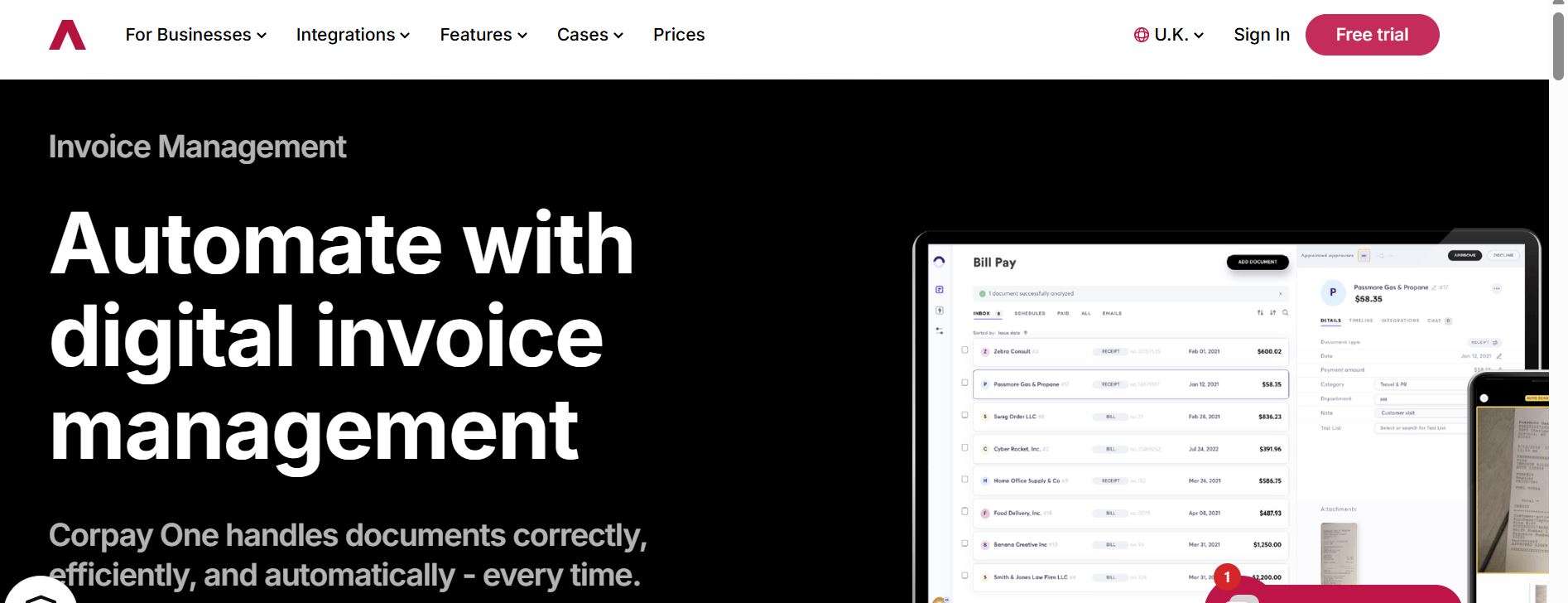

Handling business payments manually can be time-consuming and error-prone. Corpay One aims to solve this by offering an automated accounts payable (AP) and expense management platform for growing businesses. But does it truly simplify financial workflows?

In this Corpay One review, we’ll explore its key features, benefits, pricing, and potential drawbacks to help you determine if it’s the right solution for your business. Whether you’re a small business owner or part of a finance team, this deep dive will provide the insights you need.

What is Corpay One?

Managing business expenses shouldn’t be a headache. But let’s be honest, it often is. That’s where Corpay One comes in.

Corpay One is an automated account payable (AP) platform designed to take the manual work out of bill payments, invoice processing, and approval workflows. It’s built for businesses that want to streamline payments, reduce errors, and integrate seamlessly with accounting software like QuickBooks and Xero.

Think of it as your all-in-one financial assistant—automating everything from expense approvals to vendor payments so you can focus on growing your business.

What are the main features of Corpay One?

Corpay One has features designed to make financial management more efficient and transparent. Whether you’re a small business looking to streamline your workflow or a large enterprise managing multiple payments, these features can help.

1. Automated Invoice Processing

Handling invoices manually can be time-consuming and error-prone.

Corpay One eliminates this hassle by allowing you to scan, upload, or import invoices. The system automatically extracts key details like vendor name, amount, and due date, ensuring accuracy while reducing the risk of missed payments.

For example, if a company receives invoices from multiple suppliers, Corpay One can categorize and match them to existing purchase orders, minimizing discrepancies.

2. Smart Approval Workflows

Managing approvals across different departments can get messy, especially with large teams. Corpay One lets businesses set up custom multi-step approval workflows based on transaction amount, department, or vendor.

For instance, you can configure an approval rule where expenses under $500 get auto-approved, while anything higher needs management sign-off. This keeps financial controls tight while reducing bottlenecks.

3. Payment Flexibility and Vendor Management

Businesses don’t always pay vendors the same way. Corpay One offers multiple payment options, including ACH transfers, wire payments, checks, and credit cards.

If a vendor only accepts bank transfers, you can schedule an ACH payment directly within the platform. Also, recurring payments ensure vendors get paid on time without manual intervention. This is especially useful for businesses with monthly subscription costs, lease payments, or vendor contracts that require timely payments.

4. Real-Time Accounting Integrations

One of Corpay One’s biggest strengths is its seamless integration with QuickBooks, Xero, and NetSuite. Once a transaction is completed, it’s automatically synced with your accounting software, keeping your books updated in real time.

If your finance team spends hours reconciling payments at the end of each month, this feature alone can save significant time and reduce errors.

5. AI-Powered Expense Tracking & Fraud Prevention

Corpay One isn’t just about payments—it also helps detect anomalies in spending. Its AI-driven insights track patterns and flag suspicious transactions.

For example, if an employee submits an expense claim for an unusually high amount compared to previous expenses, the system can trigger an alert for review. This helps businesses prevent fraud and optimize budgets.

What are the Pros and Cons of Using Corpay One?

Pros

- Automation: Corpay One eliminates much of the manual work involved in accounts payable, automating invoice processing and payment approvals. This reduces administrative time and minimizes the risk of errors, allowing your team to focus on more strategic tasks.

- Seamless Integrations: It integrates smoothly with accounting platforms like Xero and QuickBooks. This means no need for manual data entry or syncing across multiple tools. The integration helps keep your financial records up-to-date and accurate.

- Advanced Security: Corpay One offers advanced security features such as fraud protection and customizable user access controls. These features ensure your financial data is protected, reducing the risk of unauthorized transactions or data breaches.

- Cashback Opportunities: Corpay One’s business and virtual cards allow you to earn cashback or rebates on purchases, which can help your business save on everyday expenses. This can be a valuable perk for companies that frequently make purchases. This cashback or earn rebates is attached to business expenses with smart business MasterCard or universal fuel MasterCard.

Cons

- Learning Curve: While the platform is user-friendly, there can be a learning curve for those new to digital payment solutions. Some features may require some time to understand and fully utilize.

- Not Ideal for Very Small Businesses: Though it works well for mid-sized businesses, some users find that Corpay One’s features may be overwhelming for smaller businesses. The full benefits may not be as evident for those with fewer employees or simpler financial processes.

- Support Limitations: While Corpay One offers customer support, some users have mentioned that response times can be slow, especially during peak periods. Immediate assistance may not always be available, leading to occasional delays.

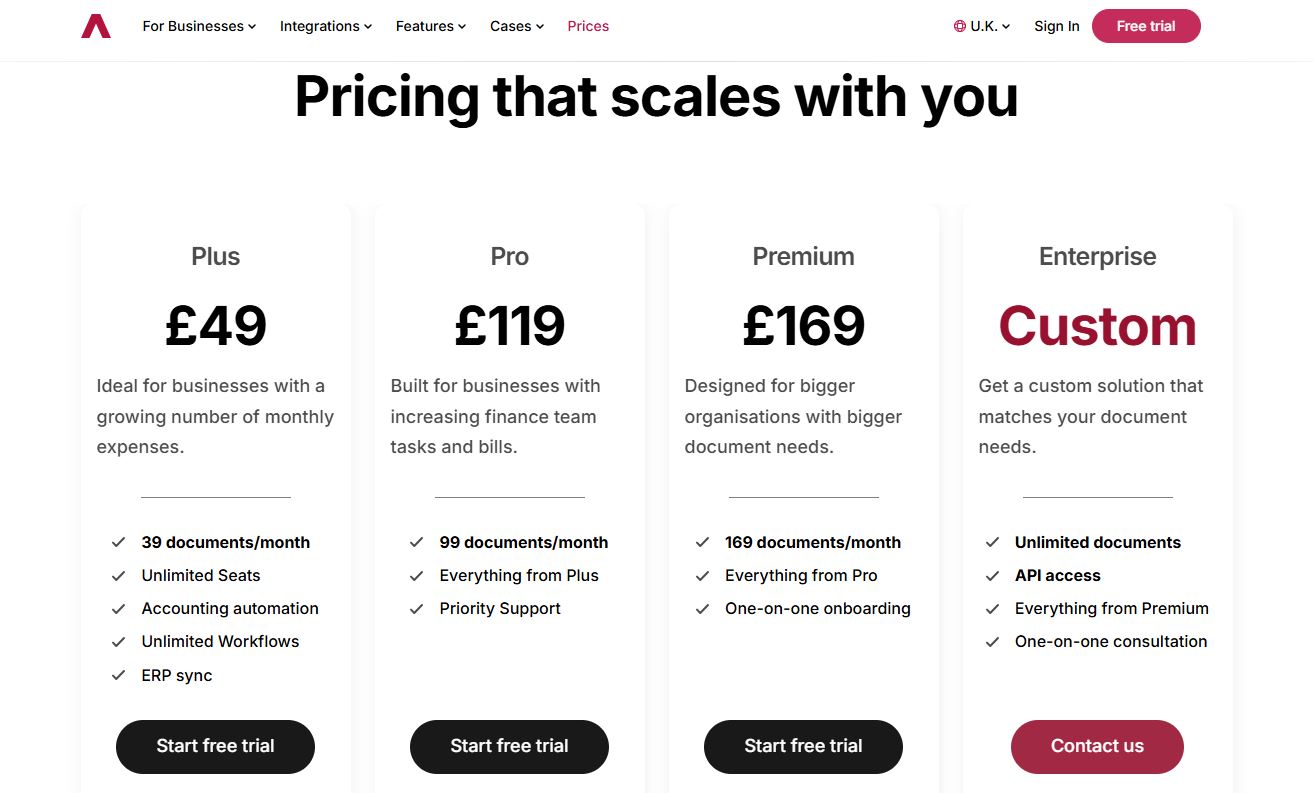

Corpay One Pricing: Which should you choose?

Corpay One offers flexible pricing based on your business needs. The platform has a pay-as-you-go model, which works well for businesses that need scalability.

Pricing typically varies depending on the number of users, cards, and the level of service required. Smaller businesses may benefit from the basic plan, while larger companies might need the premium plan with more advanced features like extra reporting tools and integrations.

Visit Corpay One Pricing Page to learn more

Is Corpay One suitable for small businesses?

While Corpay One is designed for businesses of all sizes, its advanced features may be more beneficial for medium—to larger businesses. For small businesses, it offers essential tools like invoice processing, business cards, and cashback options.

However, the learning curve and feature set might be more than necessary for companies with simpler financial needs. If you’re a small business looking to automate processes, Corpay One can still be a good choice, but be prepared to grow into its capabilities.

Final Verdict: Is Corpay One worth it?

If you’re looking for a solution to streamline your accounts payable, improve security, and earn rebates on purchases, Corpay One is worth considering. Its integration with accounting platforms like Xero and QuickBooks makes it easy to incorporate into your existing workflow.

However, if you’re a small business just starting or have limited financial complexity, you might find the platform’s full capabilities overwhelming.

Overall, Corpay One is a great tool for businesses looking for efficiency, security, and flexibility in their financial processes.

Signup to see it in action.

FAQ

1. Who are the typical users of Corpay One?

Corpay One is primarily used by medium-to-large businesses across various industries, including construction, healthcare, and nonprofits. It’s ideal for companies that need to automate financial processes, manage multiple accounts, and improve cash flow visibility.

2. What other apps does Corpay One integrate with?

Corpay One integrates with accounting software like Xero and QuickBooks, along with popular apps like Zapier, enabling users to automate workflows and sync financial data across platforms.

3. Does Corpay One offer an API?

Yes, Corpay One offers an API for businesses that want to integrate the platform with other systems or create custom workflows to meet specific needs. This gives businesses more flexibility to tailor the platform to their unique operations.

Related Article:Bill.com Reviews 2025: Features, Benefits & Pricing